Rubles, Renminbi and Yuan—Oh My! The Geopolitical Fortunes of Foreign Exchange

Suppose you were embarking upon the purchase of a car. A new one is out of the question; you don’t have that kind of money. You’ve been saving for this for a long time. You’ve chosen a nice used Lada—they’re a good Russian brand. You’ve come to terms with the seller so you pull out a bundle of… American dollars—you’re in Moscow, after all. You remember a time in the late 1990s when the Russian Central Bank magically removed three zeroes from the face value of its currency. 1000 rubles became 1 ruble overnight. Then there was that time when President Gorbachev voided all 50- and 100-ruble notes in a matter of days in 1991. It could happen again. But not to dollars. So, the deal is done.

There are few countries outside of the Russian Federation where rubles can be easily used for everyday transactions. Even today a variety of foreign banknotes are unofficially preferred in Russia over its native ruble. Why? Russia is the largest country by area on the planet, rich in natural resources, with a distinguished history and nuclear weapons. But the ruble is a shadow of what it could be both domestically and on world markets, a facsimile of “hard currency.”

Now China, there’s a country with economic muscle! An enormous, highly disciplined population. Everything seems to be made in China, including nuclear weapons. They own piles of U.S. securities. Surely the yuan can be used at the corner bodega or the car wash? Outside of China and a few neighboring countries, probably not.

As of this writing, the Russian ruble is worth a little less than a penny in U.S. dollars. The Chinese yuan trades against the U.S. dollar at about 7 to 1. Is Adam Smith’s “hidden hand” secretly discounting the currency of countries with a significant socialist heritage? Well yes, in a sense it is. Socialism’s centralized planning dilutes (proponents might say “condenses” or “distills”) self-interest in economic terms and the global market doesn’t yet trust it, or at least hasn’t integrated successful long-term models of it. Nationalized or communist-inflected industries can be opaque to market intelligence and subject to political interference or collusion—hence America’s national security concerns about the Chinese company ByteDance, owner of the popular social media platform TikTok. For better or worse, since the end of World War II the U.S. dollar has been the world’s reserve currency; it’s recognized and honored pretty much everywhere. This is a huge benefit to the United States—also a danger. How did it come to be?

Readex has some excellent digital collections suitable for charting the geopolitical aspects of foreign exchange. In this essay we’re using BBC Monitoring: Summary of World Broadcasts, 1939-2001. It will provide us with an English-language reference distinct from U.S. sources, and a comprehensive perspective from which to examine global economic relations.

The beginnings of what has been widely criticized as “dollar imperialism” can be traced to the United Nations Monetary and Financial Conference held over the course of twenty-one days in July 1944 at the Mount Washington Hotel, a resort in Bretton Woods, New Hampshire. The conference site was chosen for its secluded, majestic setting and as a respite from the heat and humidity of major East Coast American cities.

As World War II ground to a conclusion the Allied countries were keen to prevent a global economic collapse once peace was reestablished. The U.S. was the preeminent wartime power and a creditor to both Great Britain and the USSR, so the conference took place on American soil and largely on American terms. Over 700 delegates participated, representing forty-four countries.

U.S. Treasury Secretary Henry Morgenthau, Jr. presided over the conference. It was organized into two commissions. Commission I was led Harry Dexter White, Assistant Secretary of the U.S. Treasury. That body was tasked with creating the International Monetary Fund (IMF). Commission II was chaired by the eminent British economist John Maynard Keynes. Its work led to the creation of the precursor to the World Bank. Both entities were intended to facilitate worldwide reconstruction and development and to promote economic stability. They continue in that mission today.

One person who most definitely was not invited was Hitler’s Minister of Economics, Walter Funk. BBC Monitoring has excellent commentary by Funk via the German Home Service on July 7, 1944, as the monetary conference was taking place. Funk had some sharp words about the proceedings:

One might think that, at the time of a world-wide military and political world conflict, there were more important things than discussions on a world currency plan. An impartial observer might ask what could be the practical value of discussing post-war international currency relations before this world-shaking struggle, with its tremendous upheavals and revaluations and its horrible destruction of lives and property, is decided. The answer, however, reveals the background, or at least the political and propaganda side, of the enemy’s currency discussions which are being pursued with so much expense, eagerness, and clamour for prestige. The world was supposed to believe that the Anglo-Americans considered their victory over National Socialist Germany and her Allies already so absolutely certain that it was, so to speak, a matter of great urgency to deal with peace plans. But why just currency plans? Because to Anglo-US money imperialism - we also call it Plutocracy - to think in terms of money and to rule by means of money, is the supreme law of life and the highest political (15 second break in transmission). As a result of political unreason, alterations in the economic and social structure, and especially the USA's foolish attitude in her foreign trade policy, these essential conditions became illusory.

From Readex: BBC Monitoring: Summary of World Broadcasts

At the Bretton Woods conference itself there were differing views on Germany’s role in postwar international finance. Morgenthau favored a deindustrialized Germany that could never again initiate or sustain a war. Assistant Secretary White was of a more internationalist mindset, open to reintegrating Germany and Japan into the financial family of nations. He also successfully courted Soviet participation in the conference. This left him vulnerable to charges of being a communist sympathizer, even a spy for the Soviet Union. Although no wrongdoing was conclusively proven, this and similar allegations relating to Japan tainted White’s reputation during his lifetime and afterwards.

While it was true that White was not averse to a Soviet role in global finance despite fundamental differences, his larger objective was to establish a strong U.S. dollar pegged to the price of gold; neither the ruble nor the British pound sterling was as reliable a source of value at that time. His convictions won the day, and the U.S. dollar was accepted as convertible for gold at $35 per ounce. All other countries’ currencies were indexed to the U.S. dollar. Member countries would contribute jointly to the IMF and the International Bank for Reconstruction and Development, and those institutions would provide loans and guidance, and enforce financial standards for countries in need of their resources.

This system lasted until August 1971 when foreign holdings of dollars outstripped U.S. gold reserves, and U.S. President Richard Nixon ended the convertibility of the dollar into gold. Shortly thereafter the dollar’s value “floated” against other currencies, as it does today. A commentator on Moscow radio in 1971 noted that dependence on the dollar for economic stability has its downsides when the dollar itself is overvalued.

From Readex: BBC Monitoring: Summary of World Broadcasts

There’s truth to the comment that the United States was diversifying its inflation risks to countries with substantial holdings in dollars. The United States can borrow its way out of financial difficulty so long as the dollar is seen as a haven for foreign investors. This is even more the case today as America’s national debt has risen dramatically. Printing money or issuing government bonds with the expectation that the world will automatically acquire those instruments on terms favorable to the United States is a seductive and dangerous indulgence.

Americans recently encountered a mild inflationary cycle in the years following the COVID-19 pandemic when annual inflation reached about 7%. Inflation has since dropped to about 3% but it persists as an issue in America’s 2024 presidential election.

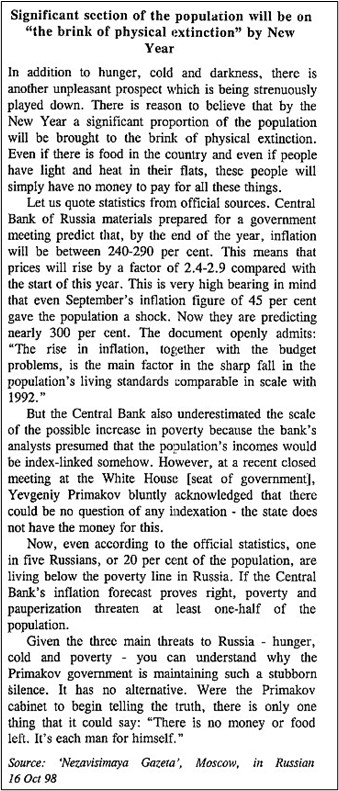

As described in an excerpt from Moscow’s Nezavisimaya Gazeta in late 1998, Russians confronted a calamity on a far greater scale following the collapse of its foreign exchange market and the default on payments of its government bonds. In retrospect, Russia’s annual inflation rate in 1998 was “only” about 84%—still plenty high but mercifully less than the 240-290% range suggested as leading to “the brink of physical extinction.”

In general terms, when Russia’s nationalized industries fell into private hands following the demise of the Soviet Union in 1991, profits were offshored, and vital political and economic reforms were ineffective. Russia has also continued to be highly dependent on exporting petroleum, undergoing cycles of boom & bust similar to those of Venezuela depending on the vagaries of the market for oil & natural gas. Despite the insularity of its economy, in keeping with its Soviet heritage Russia seeks to exercise a sizable international security role, waging wars in Syria, Chechnya, and now in Ukraine. Funding protracted foreign conflicts while maintaining domestic prosperity is a difficult balance for any country to achieve.

China’s economic evolution was much different. The renminbi is used for domestic transactions while the yuan is used for foreign exchange. The yuan is a unit of renminbi. The yuan dates to 1889; its name refers to the roundness of Spanish silver dollars, whereas the renminbi was first issued in 1948 as “the people’s currency.” The People’s Bank of China allows the yuan’s value to fluctuate within 2% of a midpoint it sets each day. There are claims that the yuan has been slightly undervalued by the government to make Chinese exports more attractive to foreign buyers.

Nationalist Chinese delegates were present at the Bretton Woods conference and were in favor of basing foreign exchange on the U.S. dollar; at the time China too was a debtor to the United States and was dealing with Japanese and Soviet incursions on its territory. With the conclusion of World War II and the defeat of Imperial Japan, China’s civil war escalated. China’s economy changed drastically with the communist victory over nationalist forces in 1949.

For our purposes it’s expedient to jump ahead to Deng Xiaoping who introduced “socialism with Chinese characteristics” in 1982. This shift away from Stalinism is a significant reason why the Chinese economy has remained relatively stable while Russian economic progress has been highly erratic. The Chinese also had a head start on the Soviet Union’s transition to a mixed economy, and they proceeded more carefully and systematically. Government leadership was much stronger and more consistent.

Incidentally, the emphasis on “independence and self-reliance” echoes North Korea’s Juche ideology, but North Korea has only become more isolated from world affairs whereas China has embraced its international role.

Among Deng’s many reforms was the reopening of the Shanghai Stock Exchange in 1990. That trading forum traces its roots back to the mid-nineteenth century when shares and commodities were exchanged in Shanghai’s International Settlement, a territorial concession in which foreign nationals enjoyed broad latitude in their legal and commercial affairs. The Shanghai exchange was closed following China’s Communist Revolution in 1949. In the report below, two government officials tour the newly reopened exchange in 1991. Premier Li Peng emphasized that “the stock exchange involves risks” but concluded that “The exchange of securities serves the socialist economic construction.” Since 2017, Xi Jinping Thought has elaborated on Deng’s innovation in terms of sustainable development consistent with socialist ideals.

Russia’s introduction of market dynamics into its economy during and since the restructuring of the Soviet Union in 1989-91 could be conservatively described as “dramatic.” We might as well jump right in with a speech by President Mikhail Gorbachev in 1990. The reader can sense his frustration: the transition is both urgent and logistically complex. Of one thing he’s convinced, however. “…there is no return to the command system in the economy, nor can there be.”

What are people still criticising the plan for? They say it’s not clear how we shall introduce a market when our “tools” are not ready. But the point is that we need this seven- or eight-month preparatory period precisely to work on it. We should adopt a law on taxes, an anti-monopoly law, a law on entrepreneurialism, on small and medium-sized enterprises, laws on a credit-financial and banking system, on a stock exchange and on social welfare. We cannot enter the market without all this. The establishment of an infrastructure which is necessary for the market plus a social welfare machinery—all this should be thoroughly worked through.

---

I am convinced of one thing: there is no return to the command system in the economy, nor can there be. Let’s tell the people the whole truth about this system, at last. In terms of resources, for instance, we are no worse off than the USA. Yet if you look at the national income per capita, it’s double there. The economic system in our country is such that it is eating up our national resources. The reason for the lag is not in technology itself but in the fact of whether a person is interested in the results of his work. If we create a new economic environment for man, for the worker, then we shall put an end to the “eating up” of resources. The whole world has gone through that and I am sure of this, having met recently prominent economists from the USA, Japan and other countries. We can create such an environment if we launch in a real way the work to form a socialist market economy.

Russia’s launch of its socialist market economy did not go especially well. Those examples cited in the opening of this essay were quite real, and they had consequences. That situation where the 1000-ruble note lost its three zeroes? That was in response to the ruble trading not at 4 rubles to the dollar as in 1950, nor at 1.65 to the dollar as on March 31, 1988, nor even at 136 t0 the dollar as in March 2022, but at over 6000 to the dollar in 1997.

ROUBLE, BONDS UNDER PRESSURE

Ordinary Russians feel pinch as dollar hits R6,000 mark

Ordinary Russians felt the effects of a slump in the value of the rouble on the currency market when exchange bureaux raised the dollar rate by 30 points at a stroke on 1st December, Ekho Moskvy radio reported.

It said that by the evening of that day the dollar had hit the R6,000 mark.

“The Central Bank was unable to cope with the growing demand for hard currency, triggered by the flight abroad of capital held by foreign financial companies,” the radio said.

Ekho Moskvy radio reported on 2nd December that demand for foreign currency in cash was up again, with the dollar being sold for R6,000 - R6,020.

“The situation at bureaux de change is being likened to panic. Demand for the dollar is said to be about twice the normal level. The people running some of the bureaux, however, put this down to the fact that Christmas is coming and say that many might be buying foreign currency to celebrate abroad,” the radio said.

Christmas indeed—for those who had already converted their rubles and gone abroad! Consider that today with all the sanctions plus the expense of the Ukraine conflict the ruble trades at about 92 to the dollar. 6000-to-1 is much worse. In that respect Russia has made progress, but it has been uneven progress to say the least. The entire page shown above is instructive. The Central Bank blamed “the world financial crisis” for the crash of the ruble, spent 10-15% of its gold propping up its value, hinted that ‘surgery” may require suspending trading on the MICEX [Moscow Interbank Currency Exchange], fixing the exchange rate artificially, and defaulting on Russian government bonds. All these things did happen. Some short-term Russian bonds were promising buyers over 50% interest. The “surgery” did save the patient, but such intervention is not normal in a healthy market. Large, sudden changes in the value of a country’s money make daily life there incredibly difficult and inhibit foreign trade severely.

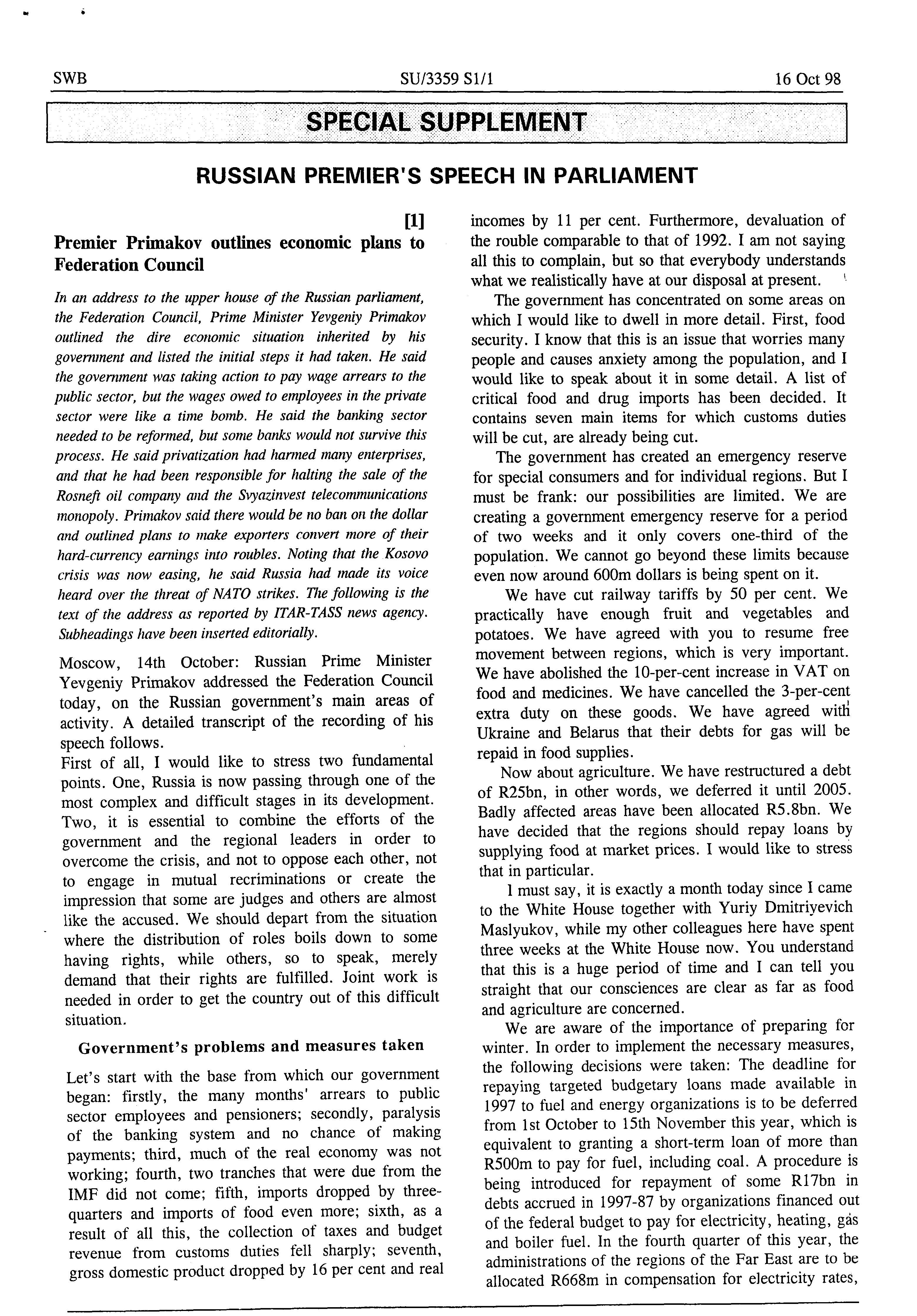

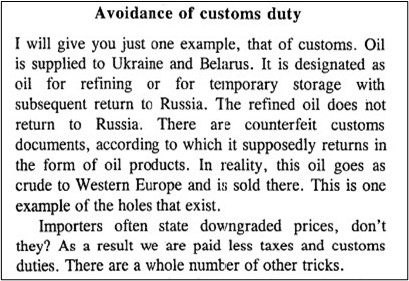

There were other, more nefarious factors at play in the Russian economy in the 1990s. Premier Yevgeniy Primakov detailed them in a speech to Parliament on October 14, 1998. The entire speech is worth reading but we’re just going to note some of the highlights.

Primakov cuts right to the chase. Food rationing is a real possibility: two weeks’ reserve for only one-third of the population. A terrible situation.

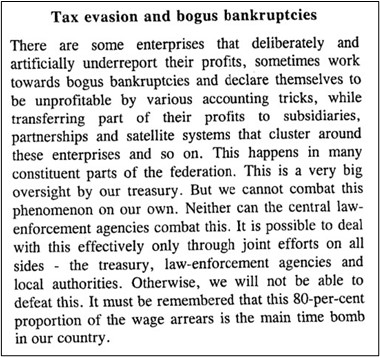

Business owners and managers are making more money by speculation and subterfuge than by operating their businesses and paying their employees and suppliers. The state is cheated out of revenue. 80% of non-civil service workers are not getting paid. Contrary to the assertion of the author of the “extinction” article excerpted above, Primakov was telling the truth.

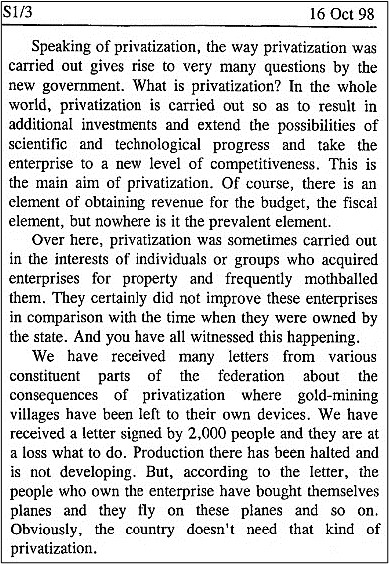

Privatization of state enterprises is individualized. Surplus value accrues to the benefit of the owners rather than to the treasury. The underside of self-interest is self-dealing. These are the oligarchs. If a gold mine can’t make money, either the vein is tapped out or something is seriously amiss.

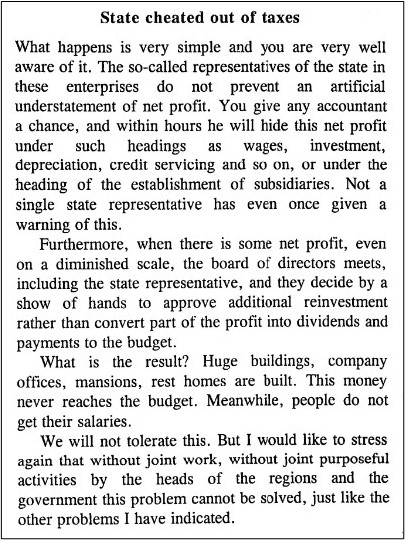

More gamesmanship. First planes, now mansions. Money goes everywhere except to the state.

It almost seems as though Russian businesspersons learned about corporate governance by watching American cinema; Wall Street (1987), and The Firm (1993) come to mind. The oligarchs condensed a century of capitalist excess into a decade.

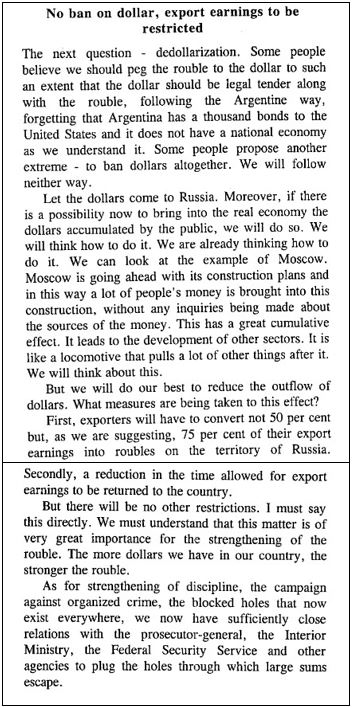

A complementary approach to economic reform would be to diminish the role and impact of the U.S. dollar in the economy. Both Russia and China are doing just that, and for good reasons. Both countries are highly averse to U.S. sanctions. Vladimir Putin and Xi Jinping justifiably want more control over their own currencies than they have while subject to U.S. economic policy through overexposure to the dollar. Just as many countries in Europe have joined the European Union and adopted the euro as a shared currency, Russia and China have banded together with Brazil, India, South Africa (the “BRICS”) and other countries to establish their own trading bloc in which the ruble and the yuan have pride of place.

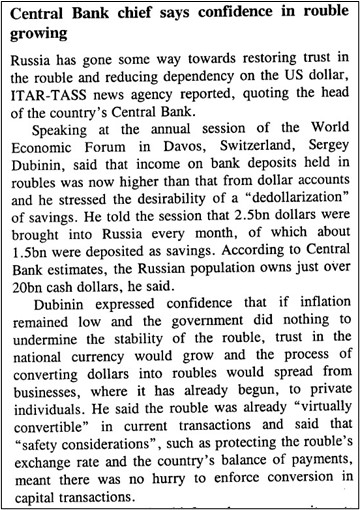

Reducing the influence of the U.S. dollar has been a source of tension in Russia. In 1996 Sergey Dubinin, head of the country’s Central Bank, was optimistic that the ruble might supplant the dollar domestically in the near future.

Two years later in the Primakov speech excerpted above, de-dollarization was viewed as less urgent than having ready access to the capital that U.S. dollars represented.

It is telling that not only are Russia and China deprecating use of the dollar, they’re also enhancing both the holdings and the convertibility of the ruble and the yuan with each other. Moreover, both countries are building up their gold reserves and cooperating in the acquisition and refining of gold. After all, Russia is the world’s second largest gold producer, and the countries share a border. Perhaps we’ll see a regional reprise of the indexing of national currencies to gold as formalized at the Bretton Woods conference in 1944.

We hope you’ll agree that Readex is the gold standard for open-source intelligence sources, research tools, and content.

Visit the Readex BBC Monitoring: Summary of World Broadcasts page for information on this collection and to request a complimentary trial.